- Flywheel Insights

- Posts

- The Reason Why Investors Obsess Over LTV/CAC (Higher Valuations)

The Reason Why Investors Obsess Over LTV/CAC (Higher Valuations)

Marc Andreessen and Ben Horowitz, founders of Andreesen Horowitz (a16z).

A16z’s post “Why Do Investors Care So Much About LTV:CAC?” inspired this breakdown.

High LTV/CAC ratios can lead to higher valuations.

It’s one of the most high-leverage metrics that astute PE and VC investors watch closely.

Small improvements in this ratio can lead to disproportionate increases in financial outcomes.

But a higher LTV/CAC ratio doesn’t just make a business more profitable. It can also lift its valuation multiple.

This means that if a company acquires customers more profitably, then its relative valuation will be higher compared to a company with a lower LTV/CAC ratio.

Let’s break these ideas down.

1) LTV/CAC increases valuation

A blog post by a16z demonstrates how improving LTV/CAC from 2x to 3x (a 50% increase) can triple a company’s valuation.

Let’s consider how.

Operating expenses can be broken down into three buckets:

General and Administrative (G&A)

Research and Development (R&D)

Sales and Marketing (S&M)

The a16z blog post suggests that when you take G&A and R&D as a percentage of Gross Profit (not Revenue), the differences in relative spend becomes smaller than when compared with revenue.

G&A as a % of Gross Profit typically ranges between 12–17% and averages 14%.

R&D as a % of Gross Profit typically ranges between 17–22% and averages 20%.

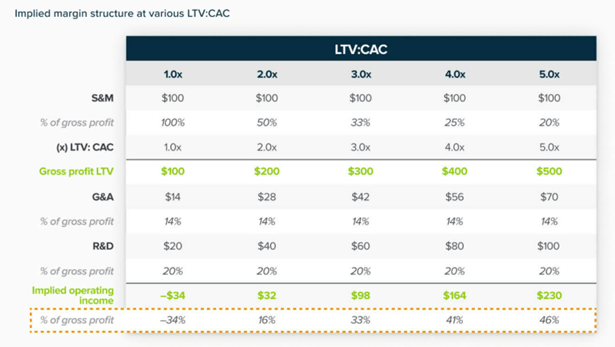

From a16z’s “Why Do Investors Care So Much About LTV:CAC?”

When R&D and G&A are measured as a percentage of Gross Profit rather than Revenue, the differences across companies narrow significantly.

Because R&D and G&A expenses (as a % of Gross Profit) are relatively consistent across companies, S&M efficiency is what ultimately drives long-term profitability.

Think about it this way:

S&M expense is your CAC.

If G&A and R&D are stable across companies, then the efficiency of S&M spending determines how profitable you are.

A higher LTV/CAC means that S&M (as a % of Gross Profit) is relatively lower (due to higher customer acquisition efficiency), resulting in higher Operating Profit (or EBITDA Margins).

Higher EBITDA margins generally translate into higher valuations.

For example, if Company A and Company B both generate $100 million in revenue but have 10% and 20% EBITDA margins respectively, their EBITDA will be $10 million and $20 million. Assuming both trade at the same EBITDA multiple, Company B’s valuation would be twice that of Company A.

From a16z’s “Why Do Investors Care So Much About LTV:CAC?”

As LTV:CAC improves, implied operating margins rise sharply.

Small improvements in customer acquisition efficiency can therefore lead to disproportionately higher profitability and valuation multiples.

2) A higher LTV/CAC increases the valuation multiple

The benefit of a higher LTV/CAC just increase the profitability of a business, it also drives a higher valuation multiple.

A company’s value is the present value of its future cash flows discounted at an appropriate rate.

The more profitable a company, the more cash it is able to generate over time. This means that companies with higher margins tend to have higher valuation multiples.

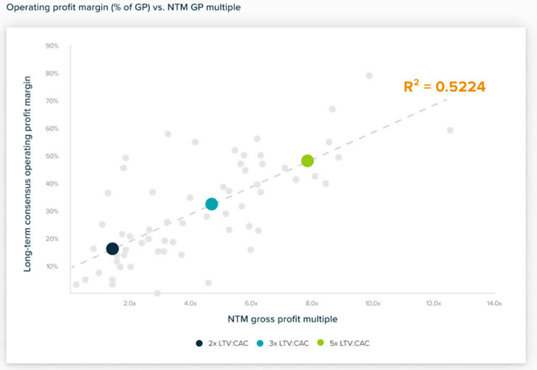

When you plot long-term operating margins against valuation multiples, the relationship between LTV/CAC, EBITDA Margins and valuation multiples become clear:

Companies with 16% margins (roughly 2x LTV:CAC) trade at around 1.5x Gross Profit

Those with 33% margins (3x LTV:CAC) trade near 5x Gross Profit

And those with 46% margins (5x LTV:CAC) reach almost 8x Gross Profit.

Better operating margin generally increases the valuation multiple.

In short:

Higher LTV/CAC → Higher EBITDA Margins → Higher Valuation Multiple

As your LTV/CAC improves, margins expand, and the valuation multiple grows disproportionately larger.

A business that’s twice as efficient at acquiring customers isn’t just twice as valuable; it can be worth three to five times more.

This is Part 3 of my breakdown of the LTV/CAC ratio in my Metrics for Scale series.

In Part 1, I explained what LTV/CAC is and why it matters.

In Part 2, I broke down how it connects to profitability and growth efficiency.

Here in Part 3, we explored how LTV/CAC directly drives valuations.

I’m eager to get your thoughts on the most important metrics impacting your business!